Not long ago, an Amazon private label seller shared on a forum (e.g., Reddit) a report that their margins on a top-selling PL item dropped from roughly 31% to 12% after the initial tariff hike.* Multiple threads discuss similar experiences of margin compression following the subsequent cascading tariff increases.

Supporting the notion that tariffs can adversely affect margins:

- Anker’s Price Increases: A Reuters report indicated that Anker, a Chinese electronics brand, immediately raised prices on roughly 20% of its Amazon U.S. listings, with an average jump of around 18% on over 100 SKUs after a major tariff hike.

- Andy Jassy’s Warning: Coverage in outlets such as the New York Post has noted that Amazon’s CEO cautioned that higher tariffs could contribute to broader economic disruptions, potentially forcing sellers to pass costs onto consumers.

Meanwhile, wholesale sellers—particularly those leveraging advanced data tools—have the opportunity to reduce cost spikes vs peers by sourcing domestically or from regions less affected by tariffs. By using solutions like Analyzer.Tools, sellers can quickly pivot away from high tariffed suppliers and quickly identify profitable, lower-risk products to maintain steadier margins.

CPO Outlets: “we have seen over a 50% sales lift after only a few months of use.”

*Note: The margin drop figures are based on anecdotal reports from seller discussions and reflect the experiences of some within the community, not all sellers.

What we'll cover:

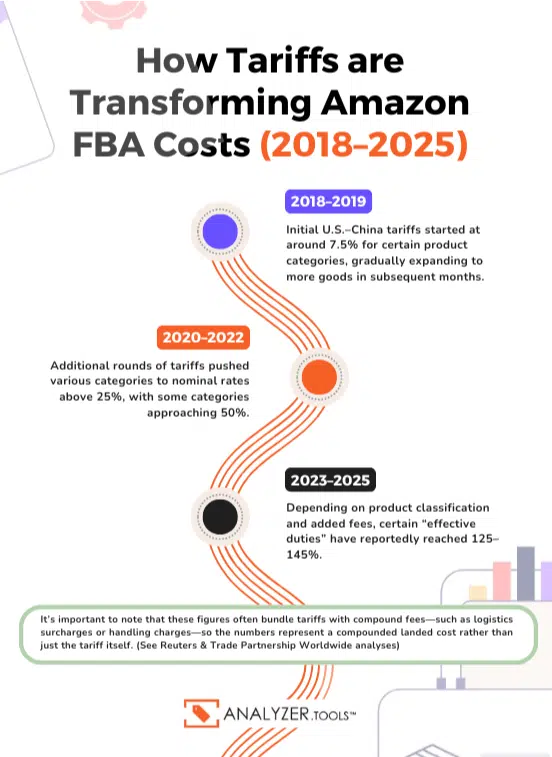

How Tariffs Are Transforming Amazon FBA Costs (2018 - 2025)

Timeline of Escalation

- 2018–2019: Initial U.S.–China tariffs started at around 7.5% for certain product categories, gradually expanding to more goods in subsequent months.

- 2020–2022: Additional rounds of tariffs pushed various categories to nominal rates above 25%, with some categories approaching 50%.

- 2023–2025: Depending on product classification and added fees, certain “effective duties” have reportedly reached 125–145%. It’s important to note that these figures often bundle tariffs with compound fees—such as logistics surcharges or handling charges—so the numbers represent a compounded landed cost rather than just the tariff itself. (See Reuters & Trade Partnership Worldwide analyses)

De Minimis Rule Changes

Traditionally, U.S. customs allowed imports valued under $800 to be duty-free, but recent policy adjustments have effectively reduced this benefit for many Chinese goods. (Sources: Carbon6, Seller Labs)

- Who It Hurts: Private label and Chinese sellers who rely on frequent, small shipments.

- Immediate Impact: More shipments now incur duties, increasing overall landed costs.

Supply Chain Disruptions & Real Seller Examples

- Delayed Shipments & Inspections: Business Insider notes that sellers (like one cited under the pseudonym “Lisa Lane”) have experienced port slowdowns and higher freight costs, increasing annual expenses.

- Children’s Toy Example: Reuters reported that a toy with a production cost of $3 might climb to $7 after applying tariff surcharges—prompting sellers to mark up prices anywhere between 20–50% to preserve margins.

“China +1”: In response to these pressures, many Amazon sellers are seeking to diversify production to include countries like Vietnam, India, or Mexico. Sources such as Vietnam Briefing and Gembah indicate that labor costs in these regions can be significantly lower than in China, helping mitigate over-reliance on one supply chain. However, switching supply lines for manufacturing products can take a long time and Amazon sellers specializing in private label products may hesitate before making such an investment due to uncertainty.

Private Label — The Tariff “Punching Bag”

Private label sellers manage sourcing and production directly, which means:

- Production Cost Surges: When tariffs significantly hike raw material costs (as seen in the toy example increasing from $3 to $7), profit margins can become squeezed.

- R&D + Branding Overhead: Combined with shipping unpredictability, many PL sellers have seen dramatic margin compression. In many cases making their products not viable for sale without 30%+ price increase to buyers.

- Cash Flow Headaches: With each batch facing variable duties, reorder planning can become unpredictable.

- Uncertainty "Freeze": With tariff rates constantly changing, many private label sellers are "frozen" with uncertainty and simply waiting to see where things settle before they can act.

Wholesale — Stable, Scalable, and Less Exposed

Wholesale sellers can source more dynamically, changing suppliers "on the fly" to source from domestic suppliers or those less affected by tariffs:

- Sourcing Flexibility: Wholesale sellers are not tied to a specific logistics chain and can switch suppliers from high tariffed regions to lower tariffed regions within days. Certain Amazon tools like Analyzer.Tools can help wholesale sellers find new supplier relationships and quickly analyze their product catalogue to purchase new inventory.

- Distributed Margin Compression: In many wholesale relationships, the supplier, brand or distributor will absorb some of the tariff cost increase.

- Support Channels: Some wholesale vendors have reportedly received targeted relief or flexible terms during tariff surges. (Business Insider)

Analyzer.Tools Angle: Tools like Analyzer.Tools scan thousands of wholesale SKUs, returning around 82+ key data points (based on user reviews on G2). This helps sellers quickly pinpoint the most profitable, tariff-resilient items.

Retail Arbitrage & Online Arbitrage- Less Exposed but Risky

RA/OA sellers focus on sourcing domestic deals (either in-store or online) and then reselling them on Amazon:

- Indirect Tariff Effects: Although retailers might adjust prices to cover their own costs, RA/OA sellers generally avoid direct import duties.

- Flexibility: When a product line becomes unprofitable, RA/OA sellers can more easily pivot to new listings without the sunk costs associated with private label production.

- Amazon Account Deactivation Risk: While not explicitly banned, OA/RA involves navigating Amazon's policies, intellectual property, and potential legal issues. Many retail arbitrage & online arbitrage sellers face Amazon account deactivation issues which may require a long and painful process to reinstate.

Why Wholesale Wins in 2025

Imagine a scenario where a new 10% tariff spike hits mid-year. The table below provides an illustrative comparison of margins across different sourcing models:

| Model | Pre-Tariff Margin | Post-Tariff Margin (Illustrative) |

|---|---|---|

| Private Label | ~15–50% | < 15% (or negative) |

| Wholesale | ~15–40% | ~10–30% |

| Retail Arbi. | ~10–20% | ~8–15% |

| Online Arbi. | ~10–20% | ~8–15% |

Why the Difference?

- Private Label sellers absorb manufacturing and import duty shocks directly.

- Wholesale sellers benefit from cost absorption by the original supplier or distributor.

- RA/OA models are relatively insulated, avoiding direct import-related expense fluctuations.

Note: The figures shown are illustrative estimates based on prevailing market trends.

Pivot Strategies for Struggling Private Label Sellers

For sellers experiencing shrinking PL margins due to tariff pressures, consider the following strategies:

- China +1 Sourcing

- Diversify manufacturing to include other lower-cost countries like Vietnam, India, or Mexico. Even partial reallocation can reduce risk.

- Hybrid Wholesale-PL Model

- Maintain high-performing PL items while incorporating wholesale products for more predictable revenue.

- Negotiations & Shipping Optimizations

- Work with suppliers to potentially share tariff costs, adjust shipping schedules, or consolidate freight to mitigate fees.

- Complete Wholesale Shift

- For sellers finding PL margins too squeezed, transitioning entirely to wholesale can simplify operations and stabilize margins.

Tool Spotlight — Analyzer.Tools’ Advanced Features

Heidi B. (Amazon Seller): “It goes through hundreds or thousands of products for you… saves a huge amount of time.”

Bulk Analysis with 82+ Data Points with Analyzer.tools

Analyzes extensive product lists quickly to provide 82+ critical Amazon data points to make smart sourcing decisions:

- Fees & ROI: Gain real-time insights on FBA, MFN, and tariff cost factors.

- Competitor Analysis: Understand the competitive landscape across listings.

- Historical Pricing: Avoid traps from seasonal or cyclical price changes.

Responsive Development & User Focus

- Active Feedback Loop: Users note that new features are rolled out regularly based on seller requests.

- Reliable Support: According to Yecheskel Hersh, “the developer is always reachable,” ensuring quick resolution of any issues.

Verified Results

- CPO Outlets reported up to a 50% lift in sales after identifying top-performing products.

- Bryanna G. described the tool as “absolutely awesome with communicating,” highlighting consistent performance.

Disclaimer: The figures and testimonials regarding Analyzer.Tools are drawn from user reviews and self-reported data. Individual results may vary.

Conclusion: Where Do We Go from Here?

Tariffs are unlikely to vanish anytime soon, and private label sellers with tightly managed supply chains bear the brunt of cost increases. While retail and online arbitrage can more readily adapt to tariff fluctuations, wholesale remains the model that is more flexible and generally less exposed to long term import cost surge.

- Ready to Streamline Sourcing?

- Test out Analyzer.Tools to discover why advanced Amazon sellers favor its data-driven approach for managing risk and protecting profit margins—even in volatile tariff conditions.

Final Word: While a lot remains uncertain, a data-driven approach—whether through diversified sourcing or by embracing a wholesale model—provides a solid strategy for remaining profitable in the evolving tariff environment.

References

For further exploration on these topics, consider these sources:

- Analyzer.tools: Amazon Statistics: A Look at Users, Sellers, Revenue, and Marketplace Trends

- Reuters: Reporting on Anker’s tariff-driven price hikes and cost shifts in the electronics sector.

- Business Insider: Coverage on supply chain challenges (including the “Lisa Lane” example) and Amazon’s vendor support initiatives during tariff surges.

- Carbon6 & Seller Labs: Discussions around changes to the de minimis threshold affecting Chinese imports.

- Gembah & Vietnam Briefing: Analyses of “China +1” sourcing strategies, including labor cost comparisons.

- Trade Partnership Worldwide: Insights on tariff expansions and the compounding effects of effective duties.

- New York Post: Summaries of public remarks by Amazon’s CEO regarding tariff-induced challenges.